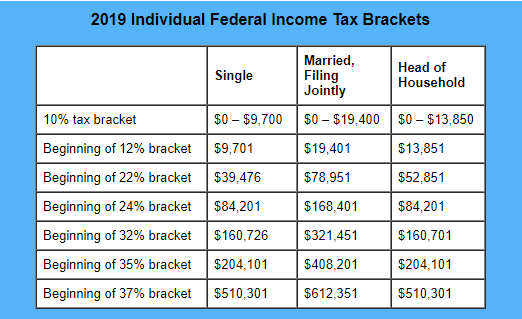

2021 individual federal income tax rate brackets

These tax rate schedules are provided to help you estimate your 2021 federal income tax. For a taxpayer with taxable income of exactly 120000 the saving is 2430.

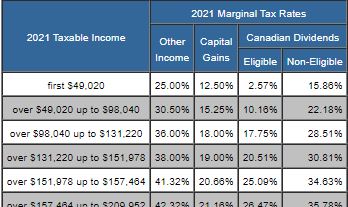

Taxtips Ca Alberta 2020 2021 Personal Income Tax Rates

1 Married Individuals Filing Joint Returns Surviving Spouses.

. The federal income tax rates remain unchanged for the 2021 and 2022 tax years. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly. For 2018 and previous tax years you can find the federal tax rates on Schedule 1.

10 12 22 24 32 35 and 37. MARRIED FILING SEPARATELY TAX BRACKETS. For a taxpayer with taxable income of 45000 the tax saving is.

19 cents for each 1 over 18200. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Compare Your 2022 Tax Bracket vs. Page 3 of 26. To find income tax rates for previous years see the Income Tax Package for that year.

Year Rates Brackets Rates Brackets Rates Brackets Rates Brackets. The income brackets though are adjusted slightly for inflation. Federal Individual Income Tax Rates and Brackets.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The 19 rate ceiling lifted from 37000 to 45000. 2020 Tax Brackets and Tax Rates for filing in 2021 2021 Tax Brackets and Tax Rates for filing in 2022 TurboTax Will Do It For You.

Find out your 2021 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts. Your 2021 Tax Bracket To See Whats Been Adjusted. TurboTax will apply these rates as you complete your tax return.

Use the tables below to find your 2019. You can find the provincial or territorial tax rates on Form 428. Dec 16 2021 Cat.

The chart shown below outlining the 2021 Maryland income tax rates and brackets is for illustrative purposes only. The 325 tax bracket ceiling lifted from 90000 to 120000. MARRIED FILING JOINTLY OR QUALIFYING WIDOW TAX BRACKETS.

SINGLE FILERS TAX BRACKETS. The tax bracket changes announced in Budget 2020 reflected in the table above were. HEAD OF HOUSEHOLD TAX BRACKETS.

Tax on this income. The personal exemption for tax year 2021 remains at 0 as it was for 2020. In Nominal Dollars Income Years 1862-2021 Married Filing Jointly Married Filing Separately Single Filer Head of Household Notes.

Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37. 2021 Tax Table3 2021 EIC Table16-2-Department of the Treasury Internal Revenue Service. Complete Edit or Print Tax Forms Instantly.

For 2019 and later tax years you can find the federal tax rates on your income tax and benefit return. Ad Access IRS Tax Forms. Discover Helpful Information And Resources On Taxes From AARP.

2021 Tax Brackets by Filing Status. Resident tax rates 202122. Do not use this overview to figure your tax.

Maryland Income Tax Rates and Brackets. If your income is under 100000 use the tax tables in the Maryland income tax booklet to figure your tax. Government taxes personal income on a progressive graduated scalethe more you earn the higher the percentage youll pay in taxes.

These rates show the amount of tax payable in every dollar for each income bracket for individual taxpayers. Tax rates for previous years 1985 to 2021. Last law to change rates was.

There are seven tax brackets for most ordinary income for the 2021 tax year. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Your tax bracket depends on your.

24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

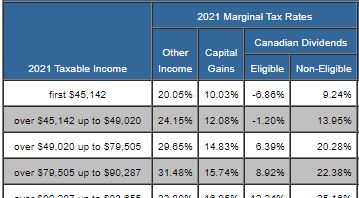

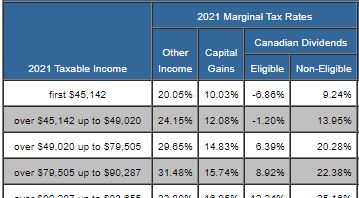

Personal Income Tax Brackets Ontario 2020 Md Tax

Marginal Tax Rates For Each Canadian Province Kalfa Law

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

2

Marginal Tax Rates For Each Canadian Province Kalfa Law

Low Tax Rates Provide Opportunity To Cash Out With Dividends

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

Tax Brackets Canada 2022 Filing Taxes

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

2021 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Personal Income Tax Brackets Ontario 2021 Md Tax

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet